In a move that’s shaking up the global economic landscape, former President Donald Trump has once again taken center stage with a sweeping announcement on tariffs. These new measures, part of a strategy he’s calling the “Reciprocal Tariff Regime,” are designed to push back against what he views as long-standing trade imbalances. Set to take effect this April, the tariffs are meant to encourage fairer trade deals and strengthen domestic industries — but not without stirring up a hornet’s nest of international reaction.

Let’s break down what’s actually happening and what it could mean for the U.S. and the world.

Across-the-Board Tariff: A 10% Starting Point

The foundation of Trump’s new plan is a general 10% tariff on all imports into the United States. This base rate applies to goods coming in from any country that does not fall under a more specific classification. The goal, according to the Trump camp, is to create a more level playing field for American manufacturers and reduce dependency on foreign goods.

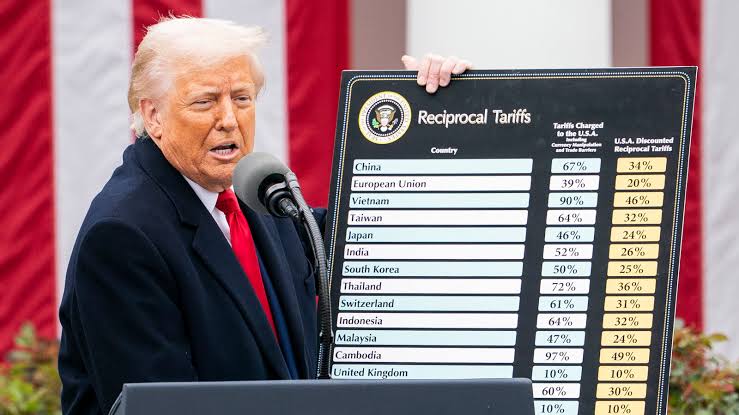

Tariffs by Country: Who’s Paying What

Beyond the general tariff, Trump’s new structure includes significantly steeper rates for certain countries — particularly those with whom the U.S. has trade deficits or strained relations. Here’s how it breaks down:

China: Goods imported from China will now carry a whopping 34% tariff. This move clearly targets what Trump sees as unfair competition and intellectual property violations.

Vietnam: Importers will have to pay a 46% tariff on Vietnamese goods, one of the highest rates in the announcement.

European Union (EU): Products from EU member nations will face a 20% tariff, part of a long-standing trade dispute over subsidies and market access.

United Kingdom and Australia: Both countries fall under the general 10% tariff, despite previous trade discussions suggesting more favorable treatment.

Japan: Imports from Japan will now carry a 24% tariff, aimed particularly at automotive and technology sectors.

Taiwan: A 32% tariff has been applied to Taiwanese products, further complicating the already delicate geopolitical relationship.

India: Indian goods are now subject to a 26% tariff, with a focus on textiles and pharmaceuticals.

Canada and Mexico: Both neighbors are facing a 25% tariff. However, certain goods that fall under the USMCA agreement may be exempt.

South Korea: Tariffs on steel from South Korea have been raised to 25%, adding pressure to an already competitive export sector.

Automobiles in the Crosshairs

A specific 25% tariff is being imposed on all foreign-made automobiles, a move that could ripple through both U.S. consumers and global automakers. Key auto parts like engines and electrical components will also face these elevated tariffs. While the intent is to revitalize American car manufacturing, critics argue that it may actually raise prices for U.S. consumers and dealers.

What’s the Strategy Here?

Trump’s rationale is rooted in the belief that the U.S. has, for too long, been taken advantage of in trade relationships. These tariffs are pitched as a way to restore fairness, bring jobs back to American soil, and reduce reliance on imported goods. Supporters believe this bold approach will boost domestic industries, especially manufacturing and steel.

Global Reaction: Shock, Disappointment, and Retaliation Plans

As expected, international leaders haven’t taken the news lightly. Countries affected by the new tariffs are expressing strong opposition, warning of economic fallout and even retaliatory measures. European leaders have criticized the move as protectionist, while Asian countries are reviewing potential counter-tariffs. Canada and Mexico are weighing their response carefully, hoping to protect their own industries without escalating the situation.

Australia, while disappointed, has signaled that it will avoid retaliatory tariffs in an effort to keep trade stable. However, the overall mood among U.S. allies is one of concern and caution.

The Economic Ripple Effect

Economists are divided. On one hand, tariffs can provide a temporary lift to struggling domestic sectors. On the other, the higher costs are likely to be passed down to consumers, particularly in industries like electronics, automobiles, and clothing. There’s also the risk of job losses in sectors that rely on imported materials.

The automotive sector, in particular, could be hit hard. Manufacturers may be forced to slow production or cut staff if supply chains become too expensive. Consumers, too, might delay major purchases if prices spike.

What Comes Next?

This latest round of tariffs is a powerful signal that Trump, should he return to office, plans to double down on economic nationalism. Whether this strategy pays off will depend on how trading partners respond — and how American consumers and businesses weather the changes.

For now, one thing is clear: The global trade game just got a lot more complicated.

“This Content Sponsored by Buymote Shopping app

BuyMote E-Shopping Application is One of the Online Shopping App

Now Available on Play Store & App Store (Buymote E-Shopping)

Click Below Link and Install Application: https://buymote.shop/links/0f5993744a9213079a6b53e8

Sponsor Content: #buymote #buymoteeshopping #buymoteonline #buymoteshopping #buymoteapplication”