The year 2025 has been quite surprising for anyone following gold and silver. Both metals have jumped in price, and suddenly everyone is talking about it again. Whether you invest or not, this rise affects almost everyone in some way, especially in countries like India where gold plays a big cultural role. Let’s break everything down in simple words so anyone can understand what’s going on.

Gold and Silver Become Safe Choices When People Are Worried

When the world feels unstable or confusing, people look for something “safe” to put their money into. Gold has always been that safe option. Silver also gets a similar effect, though a bit more unpredictable.

In 2025, the global situation has been a bit shaky. People are unsure about the economy, currencies, and future job markets. Because of these worries, many investors shifted their money into gold and silver, which naturally pushed the prices higher. It’s a simple logic: when more people want something, the price automatically rises.

Interest Rates and Money Policies Play a Big Role

One of the biggest reasons behind this rise is how central banks are adjusting interest rates. When interest rates go down, people don’t earn much from keeping money in banks, fixed deposits, or bonds. So they look for other places to put their money.

Gold and silver don’t give interest, but when bank returns are low, these metals start to look more attractive. This year, many countries showed signs of lowering interest rates, and that immediately pushed precious metals upward.

Silver Is Not Just a Metal, It’s a Key Industrial Ingredient

Gold is mostly used for investment and jewelry. Silver is different. It has a huge industrial demand. It is used in solar panels, electronics, electric vehicles, and many other modern technologies.

Since the world is focusing more on renewable energy and advanced gadgets in 2025, the demand for silver has quietly increased. And because silver supply doesn’t grow very fast, the shortage makes the price jump even more.

So while gold rises mainly because of fear and investment demand, silver rises due to both investment plus industry needs.

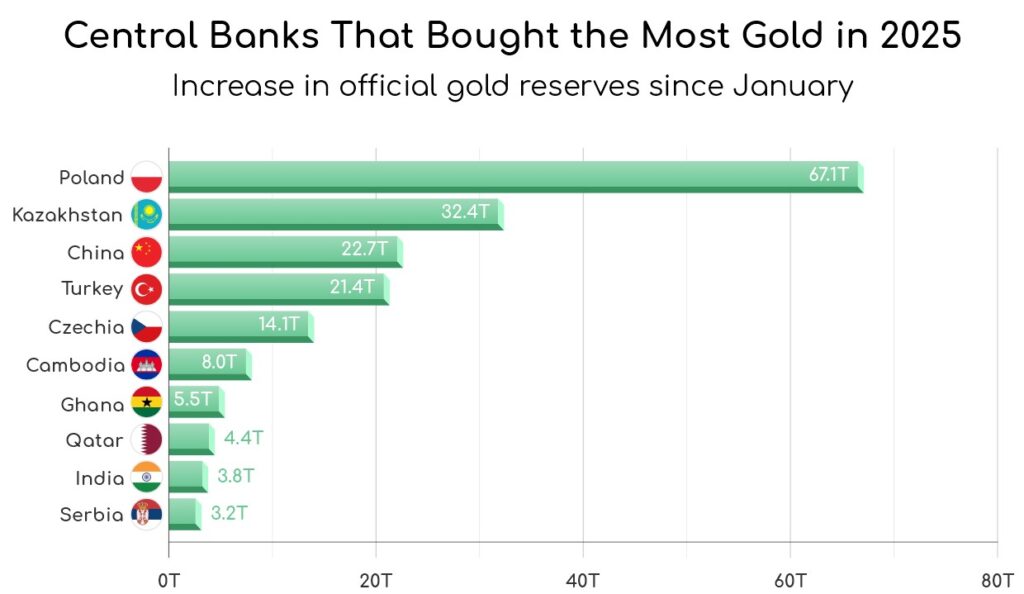

Countries Buying Gold Pushes Prices Higher

Another strong factor is that many countries’ central banks are buying large amounts of gold. They do this to strengthen their currency backup and reduce dependence on foreign reserves. This heavy buying creates a big demand, and prices naturally rise.

This trend has been seen strongly in 2025, which is one reason gold hasn’t just risen but set new records in many places.

Why Indians Are Feeling the Price Rise More

In India, gold prices always climb a little extra because of the exchange rate. When the rupee weakens against the dollar, gold becomes even costlier here. Add festival seasons, weddings, and cultural buying habits… and the demand rises more than usual.

So Indians are experiencing a stronger price rise compared to some other countries. Silver too has become significantly more expensive in local markets.

What Are the Risks Ahead?

While the rise looks strong, there are always risks to keep in mind:

- If global economies stabilise, people may move money out of gold.

- If industrial slowdown happens, silver could drop quickly.

- If interest rates rise again, investors may shift to safer bank options.

- Sudden profit-booking can bring sharp corrections.

Gold is generally stable long-term, but silver can swing fast in both directions.

Will Prices Continue to Rise?

Nothing in the market is guaranteed, but as of 2025, several things support the upward trend:

- Central banks are still buying gold.

- Interest rate cuts are more likely than hikes.

- Industrial demand for silver continues to grow.

- Global uncertainty has not gone away.

So while small corrections may happen, the overall direction remains positive unless major global changes occur.

Final Thoughts

The rise of gold and silver in 2025 is not random. It’s the result of economic worries, changes in money policies, industrial growth, and strong demand from both investors and countries. For the common person, this means jewelry and investment options are getting more expensive. Some people see this as a chance to invest, while others may prefer to wait.

“This Content Sponsored by SBO Digital Marketing.

Mobile-Based Part-Time Job Opportunity by SBO!

Earn money online by doing simple content publishing and sharing tasks. Here’s how:

- Job Type: Mobile-based part-time work

- Work Involves:

- Content publishing

- Content sharing on social media

- Time Required: As little as 1 hour a day

- Earnings: ₹300 or more daily

- Requirements:

- Active Facebook and Instagram account

- Basic knowledge of using mobile and social media

For more details:

WhatsApp your Name and Qualification to 9994104160

a.Online Part Time Jobs from Home

b.Work from Home Jobs Without Investment

c.Freelance Jobs Online for Students

d.Mobile Based Online Jobs

e.Daily Payment Online Jobs

Keyword & Tag: #OnlinePartTimeJob #WorkFromHome #EarnMoneyOnline #PartTimeJob #jobs #jobalerts #withoutinvestmentjob”